Regional measure bill passes Assembly Committee with less funds for seamless transit

On Monday, July 7, the State Assembly Transportation Committee voted to approve SB 63, the authorizing legislation for a regional transit funding measure, with Bay Area members speaking up about the importance of funding transit. But the Committee approved an amendment reducing funds for Seamless transit, following a recommendation made by MTC in late June. The Assembly Transportation Committee wants a final review when the number of counties participating has been decided and an expenditure plan is available.

Reducing the share of funds for seamless transit

The bill passed with a committee amendment reducing the expenditure on seamless transit from “up to 10%” in the previous draft of the bill to “up to 5%”. There is some continued pressure to reduce funding for seamless transit even further and it will be essential for supporters of seamless transit to speak up.

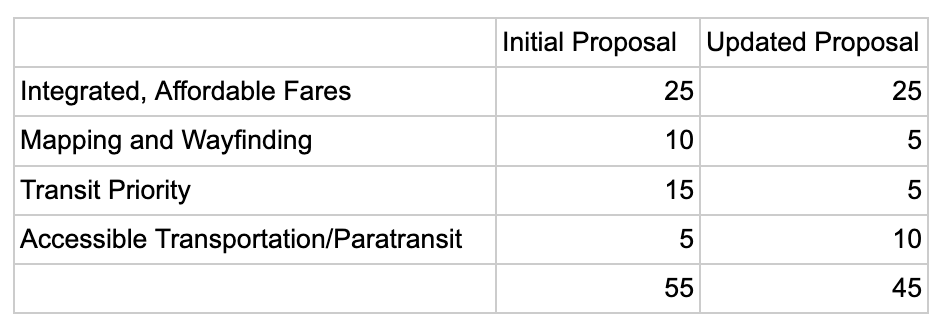

MTC’s initial proposal called for $55 million for seamless transit, which was calculated based on 10% of a 4-county measure. At the last Commission meeting, MTC voted to change its recommendation to $45 Million, which would be 5% of a 5-county measure (a 5-county measure is looking increasingly likely based on polling data and transit board discussions in San Mateo and Santa Clara Counties).

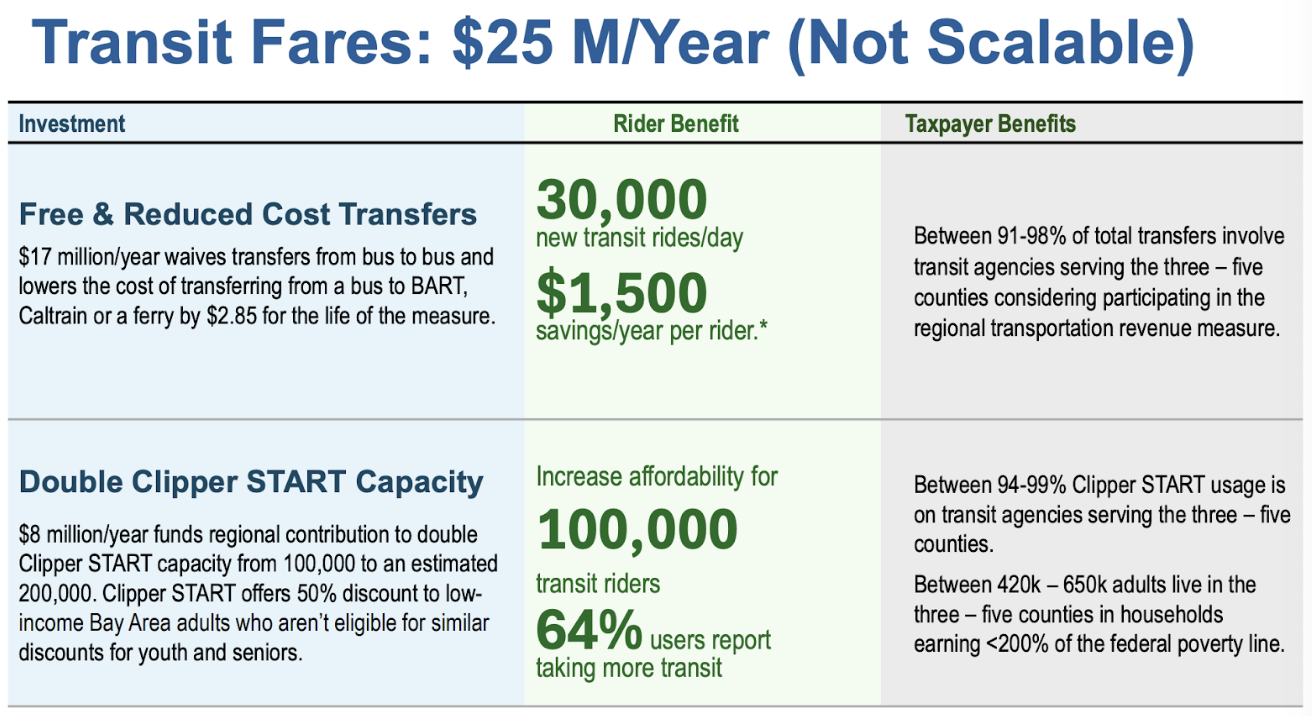

The largest investment is for integrated, affordable fares, including programs for free/reduced price transfers predicted to strongly increase ridership, and a standard low-income discount that is already proven to increase ridership and mobility for low-income people.

Coordinated paratransit and accessible transportation to make an extremely cumbersome system for people with disabilities and seniors more user friendly.

Integrated mapping and wayfinding signs, which are starting to be rolled out at key hub stations, with initial survey results showing that many more riders are able to find where they are going with new seamless signs.

Transit priority investments to make transit that runs on streets and roads faster and more reliable

The MTC recommended change preserves funding for the integrated and affordable fares, increases funding available for accessible transportation, and shrinks and combines the categories of Mapping and Wayfinding and Transit Priority, slowing the timeline to roll out these improvements and making those investments more dependent on local, state, and federal sources.

Some Assembly interest in the Gross Receipts Tax option

Assembly Member Rogers, whose district includes part of Sonoma County, and a few more members were interested in adding an option for a Gross Receipts Tax, which recent polling has suggested would raise more funds and garner more voter support. Senator Wiener replied that he is speaking to the labor stakeholders who are backing the business gross receipts tax and business stakeholders who prefer a more regressive sales tax.

Speak up to save funding for seamless transit

We are hearing there is some pressure to reduce funding for seamless transit even further. The pressure is coming from some transit agencies who express concern about “giving money to MTC.” This is nonsense - funding for integrated fares is funding that goes to transit agencies to run service - in a way that increases ridership and improves mobility for low-income people. These investments improve transit in a way that improves rider experience and increases ridership.

The discussion of the expenditure plan is being led by County Transportation Authorities - the local agencies that have a history of administering county-based transportation sales taxes, with many board members who have been locally focused, have not paid attention to demands from transit riders for a system that is convenient across agency and county boundaries, and are unfamiliar with the progress that has been made in recent years toward seamless transit.

Use the tools below to send emails to your local County Transportation Authority representatives to protext critical funding for rider-focused improvements.

Investments in seamless transit, in poll after poll, are extremely popular with votes, and will be critical to helping pass a measure at a time when many voters are skeptical of taxes and want to see investments that improve the system rather than funding the fragmented and inconvenient status quo.

Sign up here to get our blog posts sent directly to your email.